In this article we tell you all you need to know about the European Corporate Sustainability Reporting Directive (CSRD) through the 5W2H method of interrogation, i.e. Who? What? When? Where? Why? How? How Much?

Tip: Use the internal 5W2H links in the table above and the Top links at the end of each question to navigate among your most burning questions.

Who?

Who does the CSRD apply to?

The CSRD applies to:

- Public interest companies that already report in accordance with the European Non-Financial Reporting Directive (NFRD)

- Large companies that meet two out of the following three thresholds:

- More than 250 employees

- Turnover exceeds €50 million (up from €40m after EU’s 2024 redefinition of a large enterprise)

- Balance sheet exceeds a total of €25 million (up from €20m)

- Listed companies, including SMEs, excluding micro enterprises, that meet two out of the following three thresholds:

- More than 10 employees

- Turnover exceeds €700K

- Balance sheet exceeds a total of €350K

- Non-European headquartered companies with an annual turnover in the EU exceeding €150 million in the past two years and an EU branch with net revenue exceeding €40 million

- Non-European headquartered companies with an annual turnover in the EU exceeding €150 million in the past two years and an EU subsidiary that meets the definition of a large company (see 2 above)

What?

What is the CSRD?

The CSRD or Corporate Sustainability Reporting Directive is an EU directive that sets out requirements for companies to report annually on their corporate sustainability position. As per the EU, “a directive is a legislative act that sets out a goal that EU countries must achieve”.

What are companies obliged to do under the CSRD?

Entities in scope for CSRD are obliged to do the following:

- Disclose in accordance with the European Sustainability Reporting Standards (ESRS)

- Disclose using a double materiality perspective

- Align to the EU Taxonomy Regulation

- Digitally tag disclosure information in a single XHTML format according to a digital taxonomy

- Independently assure disclosures

1. Disclose in accordance with the European Sustainability Reporting Standards (ESRS)

Companies who are in scope for the CSRD are required to disclose information on their responsible business conduct (RBC) and their environmental, social and governance position using the European Sustainability Reporting Standards (ESRS).

The European Sustainability Reporting Standards standards require companies to disclose general information on their entity which includes information on their legal and organisational structure, business model, purpose, strategy, stakeholder engagement, governance, compliance, sustainability impacts, risks and opportunities and ESG materiality assessment processes and findings.

In scope companies are also required to disclose company-relevant impact information in relation to:

- Climate change

- Pollution

- Water and marine resources

- Biodiversity and ecosystems

- Resource use and circular economy

- Own workforce

- Workers in the value chain

- Affected communities

- Consumers and end users

- Business conduct

2. Disclose using a double materiality perspective

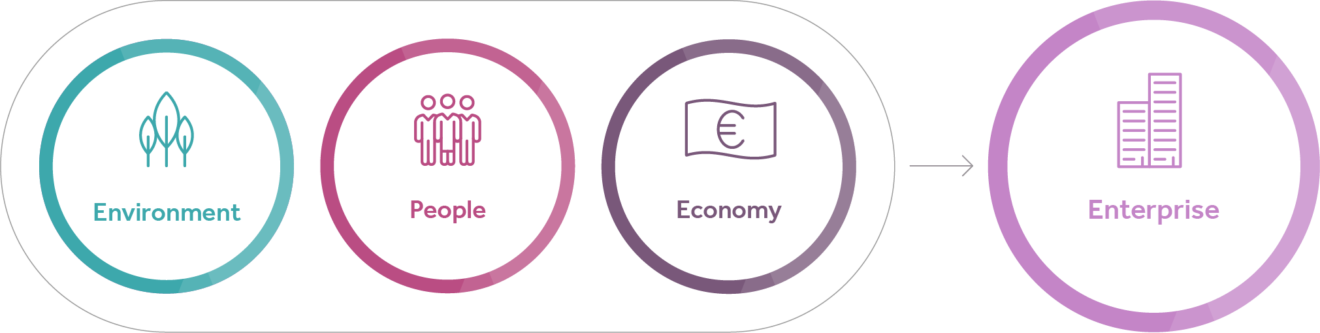

Materiality is the assessment of how important or significant an environmental, social or governance impact or topic is to an enterprise and/or its stakeholders. As the enterprise and its stakeholders may have different ways of determining importance or significance depending on their viewpoints and priorities, the EU and all major international sustainability and ESG reporting standards and frameworks have converged on three common perspectives from which to assess materiality:

- Impact materiality

- Financial materiality

- Double materiality

2.1 Impact materiality

Impact materiality assesses the impact the enterprise has on people, the environment and the economy, either directly, where the enterprise causes or contributes to the impact, or indirectly, where it is linked to the impact through its relationships with suppliers or partners, who themselves directly cause or contribute to the impact.

2.2 Financial materiality

Financial materiality assesses the impact of

sustainability and ESG matters on the enterprise,

assessing how enterprise value and value drivers,

financial performance, position and outlook are

impacted (i.e. outside-in) by these externalities.

2.3 Double materiality

Double materiality assesses materiality from both an impact and financial materiality perspective, assessing how the enterprise impacts others and how the enterprise is impacted by its impact and by sustainability and ESG matters and topics.

3. Align to the EU Taxonomy Regulation

In addition, companies that refer or want to refer to certain of their activities as ‘low-carbon’ or ‘sustainable’ must also prove that these activities align to the EU Taxonomy Regulation for sustainable activities. This requirement is intended to prevent conscious or unconscious greenwashing by companies.

The EU Taxonomy Regulation, published in 2020, defines a classification system that “establishes the criteria for determining whether an economic activity qualifies as environmentally sustainable for the purpose of establishing the degree to which an investment is environmentally sustainable”. It also requires entities to transparently disclose three specific KPIs that relate to the proportion of their capital, operational expenditure and net turnover from products and services associated with economic activities that qualify as environmentally sustainable.

The six environmental objectives currently covered by the Taxonomy Regulation are as follows:

- Climate change mitigation

- Climate change adaptation

- The sustainable use and protection of water and marine resources

- The transition to a circular economy

- Pollution prevention and control

- The protection and restoration of biodiversity and ecosystem

Each objective currently has (climate change mitigation and climate change adaptation) or will have (WIP by European Commission) a set of technical screening criteria which determines the conditions under which an activity significantly contributes to or significantly harms the environmental objective.

The Regulation also defines minimum social safeguards (MSS) that must be in place by those entities carrying out the economic activity to ensure their alignment to the following international instruments (see previous article on responsible business conduct obligations):

- OECD Guidelines for Multinational Enterprises, 2011

- UN Guiding Principles on Business and Human Rights, 2011

- ILO Declaration on Fundamental Principles and Rights at Work, 1998

- ILO Fundamental Labour Convention

- ILO Tripartite Declaration on Principles concerning MNEs and Social Policy, 2017

4. Digitally tag disclosure information

Companies that are in scope for the CSRD must also ensure their reports are digitally tagged using the XBRL Taxonomy adopted by by EC for the European Sustainability Reporting Standards (ESRS) Set 1. While this helps investors assess information quickly and more easily, this also makes the disclosed information ‘searchable’ to generative AI systems which will allow interested parties assess and compare your sustainability position to others in seconds. In today’s cancel-culture landscape it really becomes a pressing matter for businesses to approach sustainability thoroughly and transparently.

5. Independently assure disclosures

Finally, companies are also required to independently assure their disclosures which again gives assessors confidence as to the correctness of the information disclosed.

When?

When did the CSRD come into effect?

The CSRD came into effect on the 5th of January 2023. EU member states have 18 months from that date to transpose this directive into law.

When are companies obliged to report?

The timeline for CSRD disclosure is phased based on entity type to ensure SMEs have sufficient time to prepare. Key dates are highlighted in the table below. Entity Type describes the entity; CSRD Effective Date is the date from which entities must record and manage disclosures from and the Reporting Year is the first year that entities must include collated information in their annual management report. The actual reporting date within the prescribed reporting year must align with the entities official annual reporting date for their management report as the CSRD disclosures should be included in this report.

| # | Entity Type | CSRD Effective Date | Reporting Year |

| 1. | Public interest entities already in scope for NRD | January 1 2024 | 2025 |

| 2. | Large entities that meet 2 out of 3 of the following: – More than 250 employees – Turnover exceeds €40 million – Balance sheet exceeds a total of €20 million | January 1 2025 | 2026 |

| 3. | Listed companies, including SMEs, excluding micro enterprises that meet 2 out of 3 of the following: – More than 10 employees – Turnover exceeds €700K – Balance sheet exceeds €350K | January 1 2026 | 2027 |

| 4. | Non-European headquartered companies with an annual turnover in the EU exceeding €150 million in the past two years and an EU branch with net revenue exceeding €40 million | January 1 2028 | 2029 |

| 5. | Non-European headquartered companies with an annual turnover in the EU exceeding €150 million in the past two years and an EU subsidiary that meets the definition of a large company (see 2.) | January 1 2028 | 2029 |

When should companies start preparing for CSRD?

While it may seem like there is still plenty of time before the first CSRD disclosure is due, it is worth bearing in mind that given the extent of end-to-end organisational information and updates required, a preparation programme is likely to take at least 12-18 months to establish the foundational governance, due diligence and reporting structures required, identify material topics, establish commitments, baseline measures (including scope 1, 2 and 3 GHG emissions), set targets and identify, plan and implement responses to identified impact.

In order to produce a meaningful CSRD report we recommend companies have active targets in place at least a year before their first reporting date so that they can report on their progress in relation to these targets. Working back from this then each company would ideally commence its preparation for CSRD 24-30 months in advance of its first reporting date.

| # | Entity Type | CSRD Effective Date | Reporting Year | Recommended Start |

| 1. | Public interest entities | January 1 2024 | 2025 | 2022 – 2023 |

| 2. | Large entities | January 1 2025 | 2026 | 2023 – 2024 |

| 3. | Listed SMEs | January 1 2026 | 2027 | 2024 – 2025 |

| 4. | Non-EU, EU subsidiary | January 1 2028 | 2029 | 2026 – 2027 |

| 5. | Non-EU, EU large | January 1 2028 | 2029 | 2026 – 2027 |

Where?

Where do companies disclose their CSRD information?

Companies are required to include their CSRD disclosures in a dedicated section in the company management report under the following headings:

- General Information

- Environmental Information

- Social Information

- Governance Information

Why?

Why was the CSRD introduced?

The CSRD was introduced to assist and enable the European Commission achieve its financial strategy goals as defined in its 2018 Action Plan to Finance Sustainable Growth:

- Re-orient capital flows towards a more sustainable economy

- Mainstream sustainability into risk management

- Foster transparency and long-termism

and to achieve its growth strategy goals as defined in the 2019 European Green Deal:

- Transform the EU’s economy for a sustainable future

- Eliminate net emissions in greenhouse gases by 2050

- Decouple economic growth from resource use

- Protect, conserve and enhance the EU’s natural capital

- Protect the health and well-being of citizens from environmental-related risks and impacts

- Ensure a just and inclusive transition (i.e. leave no one behind)

How?

How should companies prepare for CSRD?

At RBESG we firmly believe that any organisational change, and in particular any change that is required by law, should be delivered as a project or programme. This ensures focus, structure and most importantly accountability.

To prepare for such a programme we recommend the following steps:

- Understand your CSRD obligations

- Conduct a gap analysis to assess the gap between where your company currently is and where it needs to get to in order to be sufficiently prepared to disclose in accordance with the CSRD

- Assess your company’s strengths and weaknesses to determine if you can go it alone or whether you need additional support and guidance

- Draft your CSRD project or programme requirements

1. Understand CSRD obligations

In order to fully understand your enterprise obligations under the CSRD we recommend first familiarising yourself with the European Directive legislation text and your member state’s transposition of this Directive. Links to the Directive text and to the EU Countries National Law databases can be found in the Materiality and Compliance page of RBESG’s resources section.

Note: At time of writing, transposition of the legislation is still underway in EU member states.

Next, we recommend reviewing the European Sustainability Reporting Standards (ESRS) to identify the disclosures that apply to your business.

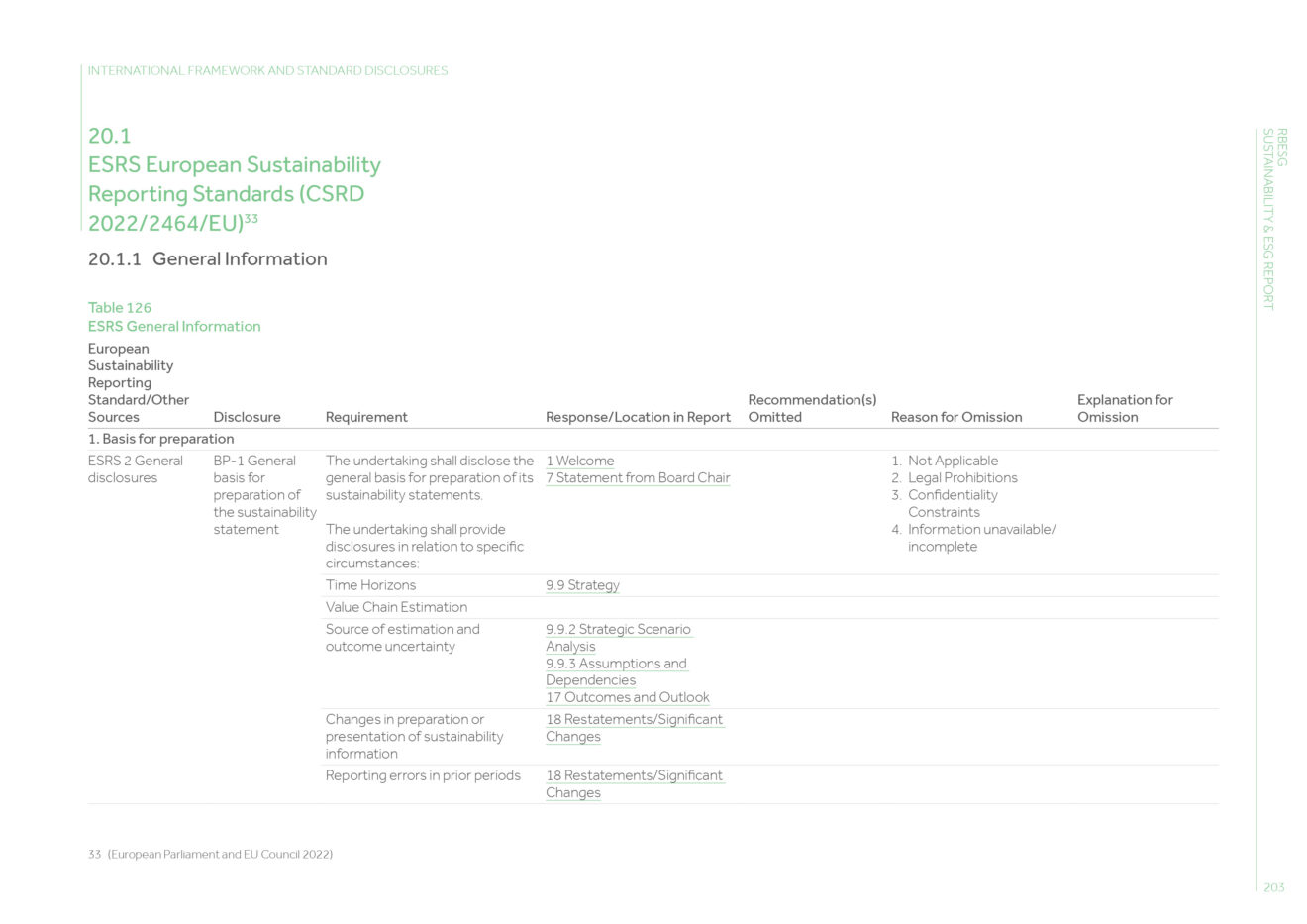

A quick way to do this initially is to download RBESG’s sustainability and ESG reporting template product STS Report (use the checkout code Welcome100 for a complimentary copy) and to navigate to section 20 International Frameworks and Standards Disclosure in the example report. Here we have included the minimum disclosure requirements that will apply to all entities subject to the CSRD.

We also recommend reviewing the disclosures required for the GRI Standards and TCFD recommendations as the European Sustainability Reporting Standards build on these. These can also be viewed in STS Report.

2. Conduct gap analysis

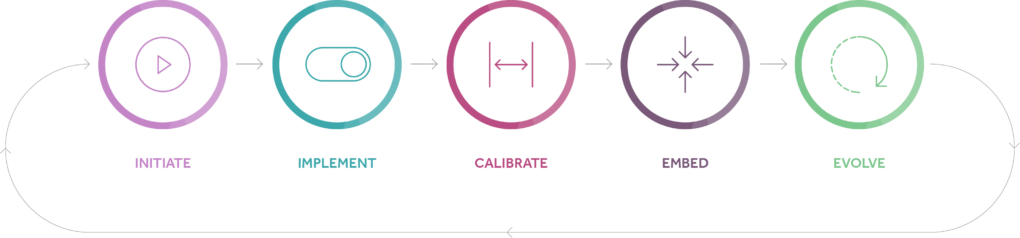

RBESG’s STS is a systematic delivery framework and methodology, complete with supporting tools, templates and worksheets, which guides companies stage-by-stage and step-by-step through the sustainability transformation process.

As a self-guide system it enables businesses deliver their sustainability and reporting requirements and obligations at their own pace and in accordance with their own capacity and capabilities.

Within STS Plan, the first three steps of the delivery framework, i.e. 1. Know Your Enterprise, 2. Establish Governance and 3. Establish Due Diligence, describe the core elements of business operations included in sustainability disclosures and guide enterprises on how to collate information on their current position in relation to these elements through use of the templates provided.

By completing step 1 of RBESG’s STS and by reviewing their position in relation to steps 2 and 3, companies can get an idea of the gap between where they are in terms of their structures, processes and data and where they need to be in relation to readiness for the CSRD.

3. SWOT analysis

To help determine whether help is needed with company CSRD preparations we recommend conducting a SWOT analysis. SWOT stands for Strengths, Weaknesses, Opportunities and Threats. It involves enterprise teams brainstorming what they are good at (strengths) versus the areas they could improve in or need help on (weaknesses) in relation to the opportunities and threats (i.e. risks) they face as an organisation. Depending on the enterprise, complying with the CSRD could be an opportunity to publicly showcase its sustainability efforts or a risk if the enterprise is under-prepared while the deadline for compliance is fast approaching.

By assessing its strengths and weaknesses, the enterprise may determine that it handles change well in an agile, flexible manner and that individuals and teams have the capacity and willingness to learn new behaviours and take on additional roles or it may determine that the opposite is true. Alternatively it may highlight that teams are stretched or expertise is lacking but that there is budget to hire additional people and/or to engage external expertise. Either way this exercise should help guide the enterprise as to its preferred delivery model, i.e. an in-house, out-sourced or hybrid model.

Note: STS Plan contains additional guidance and templates to assist enterprises with their SWOT analysis.

4. Gather requirements

Once the organisation has identified its obligations under the CSRD, analysed the gap between these and its current position and determined its capacity and capabilities in terms of delivery, the final step is to document those requirements that have arisen from the gap analysis and to add any additional ones key stakeholders may have.

When gathering requirements it is really important to engage with as many of the stakeholders as possible that will be affected or impacted by or that will affect or impact the CSRD programme. Missing key requirements through failure to engage may threaten the success of the programme and/or result in cost and schedule overruns for the team.

To assist in this process we recommend the use of MoSCoW notation for identified requirements. MoSCoW categorises requirements according to ‘Must have’, ‘Should have’, ‘Could have’ and ‘Won’t have’. These categories can then be used to define the programme delivery scope. Categorising and prioritising requirements in this way also enables the enterprise scope and phase its ambition in relation to its available resources and capacity.

| # | MoSCoW | Description |

| 1. | M – Must have | Mandatory requirement |

| 2. | S – Should Have | Recommended but not mandatory requirement |

| 3. | C – Could Have | Optional |

| 4. | W – Won’t have | Is not required/will not be included in scope |

Once defined and agreed by the highest governance body (HGB), the enterprise team responsible for delivery of its CSRD can move on to project or programme scoping, planning, approval and delivery.

How much?

How much will it cost organisations to prepare for CSRD?

The cost of readiness very much depends on each organisation, their starting position and their ambition in relation to the CSRD. For example, one organisation might already have effective governance, due diligence and reporting structures in place. They might also have defined targets and implementation plans in relation to key ESG topics such as climate change and their own workforce. Alternatively, another organisation may have no formal structures in place and may be embarking on their sustainability journey for the first time.

Additionally, the cost of implementation very much depends on whether or not the enterprise plans to deliver its CSRD programme using its own employees, external consultants or a mixture of both. Although all approaches are valid, we highly recommend that the organisation assigns one or more of its team members if its approach includes working with external consultants. This is to ensure the consultants have what they need when they need it which in turn avoids project cost and schedule overruns and to ensure the organisation realises its investment through the up-skilling of its own team.

As enterprise sustainability and ESG reporting are continual endeavours that impact every aspect of an organisation it will quickly become very costly and cumbersome for an enterprise to manage on an ongoing basis if it does not build its own capacity and capability in this area.

To determine the cost of your CSRD programme we recommend the use of STS Plan. This can be used both as a step-by-step guide by enterprises who wish to deliver their CSRD programme in-house and as a guide to those that wish to assess the level of effort involved in a sustainability and reporting programme. The latter use-case assists enterprises more authoritatively assess proposals they receive from third parties, which in turn enables them to determine if they are getting value for money

Conclusion

This concludes our 5W2H approach to CSRD. We hope that you have found this guide useful and that if anything it has highlighted the need to start your preparations for CSRD as early as possible.

If you would like to purchase STS Plan or to download your complimentary version of STS Report (use checkout code ‘Welcome100’) to support you in your endeavours please visit our shop page.

Alternatively, if you would like to discuss how RBESG or our partners might be able to help you from a consultancy/support perspective to prepare for CSRD please contact us at info@rbesg.com.